Managing and maintaining your Assurant renewal business

It was historically said that you could sell a B&C insurance policy and then 'forget it'. Just sit back and watch the renewal commission generate you further income over the next 5+ years by doing nothing!

For a lot of adviser firms, that outlook and mindset has changed already even before notification of the FCA GI pricing paper policies.

If you aren't doing anything at renewal with your B&C customers, then now is the time to change that approach.

One of the key parts of the FCA GI pricing paper is that “all manufacturers (and distributors) need to assess the value of each party operating in the distribution chain.”.

Essentially, any party receiving commission in the distribution chain should continue to offer ‘value’ in respect of that payment for New business and at Renewal.

To assist with managing and maintaining your renewal business, one of the functionalities on the Quoforma+ system is the ability to retrieve and review your upcoming renewals from the home page of your Dashboard.

Retrieve and review your renewals

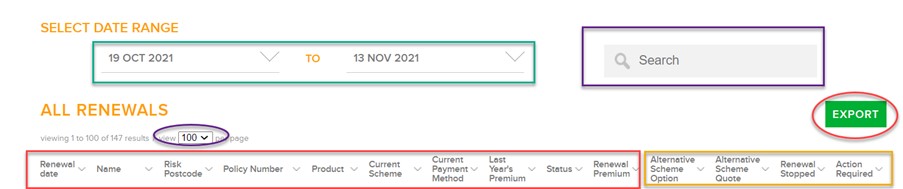

If your logins have been approved and set up at the right access level, the snapshot we now show can be crucial to ensure you have the right information prior to you making contact with your clients and adding your value at renewal.

- What premium has been generated at renewal?

- Has it significantly risen? Or has the premium even gone down?

- Have Assurant offered an alternative insurer/premium to the existing if the price has significantly risen?

- Has the existing insurer offered to renew or have they declined?

- Is there action required by you or the policyholder?

- Have we had a request for the renewal to be stopped?

- Is the client aware that they could be without cover should no action be taken?

- And is the policy still fit for purpose, any changes needed in cover, can you help?

We have set a default view but you can personalise to set and display your own search criteria:

- From a date range; search by name; view up to 100 records on 1 page which can then be export into a CSV file if you wish.

The columns will be populated with set information and where applicable, additional information will also be provided.

- Typically, you will see the current premium and then the new renewal premium for the existing insurer (red box highlight)

- But there can be other options displayed that you need to be aware of (yellow box highlight)

|

TITLE |

DESCRIPTION |

|

Alternative Scheme Option |

If the renewal has increased significantly, we will run a new quote through the system based on existing information held to see if there is another insurer that is more competitive to the existing insurer at renewal. If yes, the new insurer will show here. |

|

Alternative Scheme Quote |

Where there is another insurer that is more competitive to the existing insurer at renewal. If yes, the new insurer premium will show here. |

|

Renewal Stopped |

The renewal stopped is usually down to 1 of 2 reasons:

If either of these have happends, the instruction to show the renewal will stop will show here. |

|

Action Required |

Any call to action required on the renewal by the policyholder or adviser will show here with further information show by clicking on the text |

FAQ's

Q: I cannot see the renewals. What do I need to do to access them?

A: We have set hierarchy levels of access to selected MI within the dashboard. If you are the Principal of the business, you should have the ability to view and retrieve renewals. If you are an Adviser or GI specialist within the business, then you may not have been set up to access renewals. Please contact your Account Manager to discuss options.

Q: How long before the policy renews will this information be available?

A: Typically it will be 3-4 weeks prior to the policy renewing.

Q: Will you accept confirmation from the Adviser to switch cover to the alternative scheme or does it have to come from the Policyholder?

A: We can accept confirmation from the Adviser to switch cover to the alternative scheme. Email us at homeinsurance@assurant.com or call us on 03332 000 777

Q: Where can I find a copy of the renewal documents?

A: You can view a copy of the renewal documents from the client document vault on the customer website.

Q: How do I know if my customer has opted in or opted out of auto renewing?

A: We will shortly be adding a new column into the Retrieve Renewals table that will tell you this information.

Any further information can of course be found by speaking to your Account Manager within the Sales Support team.